Interest Rate Caps 101: What Cap Buyers Should Know

Download a PDF Copy of This White Paper

Many commercial real estate lenders require borrowers to hedge their interest rate risk by limiting exposure to rising rates. A hedge can come in many forms such as a swap, cancellable swap, collar, corridor or interest rate cap (this list is by no means exhaustive). The focus of this paper is, surprise, interest rate caps. Some lenders, typically larger banks, offer interest rate caps. Many private lenders or smaller banks do not, thereby requiring a borrower to purchase a third-party cap. In either of these scenarios, borrowers should know whether they’re getting fair market pricing and terms that conform to their governing documents. Borrowers should understand what structural alternatives are available to them (corridors, capped corridors, floored swaps, etc.). Lastly, borrowers should know what terms can be negotiated in a trade such as downgrade triggers, collateral terms and events of default. Borrowers should also understand the pros and cons of negotiating versus bidding a contract. The purpose of this paper is to give the reader a basic working knowledge of the product itself.

An interest rate cap is a contract between a buyer and a seller that establishes a maximum interest rate on a given index for a predefined term. For example, a commercial real estate developer (the “Borrower”) borrows $50 million from a bridge lender to acquire and upfit a new project. The loan is indexed to 1M Term SOFR + 2.50% for a term of three years and the Borrower is required to hedge the rate – in this case purchase a cap – for the full term of the three-year loan. There are a few terms that deserve attention prior to proceeding:

Notional or Notional Amount: The face value on which the calculation of payments on financial instruments – such as caps and swaps – are determined. The Notional Amount of a hedge generally, but not necessarily, matches the principal amount of the hedged item (e.g. – loan). Notional is never exchanged.

Counterparty: A party to a financial transaction. In the case of an interest rate cap, there are two counterparties. The buyer and the seller.

Strike or Strike Rate: The price – or interest rate – at which an option contract can be exercised. In the case of a cap, it is the rate above which a cap buyer will begin to receive payments to offset or “cap” their interest rate.

Index: A predefined, generally widely available, benchmark used to calculate the interest rate used on a financial instrument such as a loan or a derivative (cap or swap).

In-the-Money: An option whose Strike Rate has been surpassed by the underlying index. In the case of an interest rate cap, the index rate is above the Strike Rate.

Out-of-the-Money: An option whose Strike Rate has not yet been reached.

Premium: The total cost of an option such as an interest rate cap that includes intrinsic value, time value, and fees.

Intrinsic Value: The portion of an option’s premium attributable to the amount by which an option is in-the-money.

Time Value: The portion of an option’s premium attributable to the amount of time remaining until the expiration of the option contract. Premium – Intrinsic Value = Time Value.

Long-Form Confirmation: An ISDA based document that details the financial, credit, tax and default provisions of the trade. Typically used for interest rate caps in place of a full ISDA Agreement. Usually drafted by the cap provider one- or two-days post trade.

The Borrower purchases an interest rate cap by paying the Premium two business days after the price is set. The pricing call itself is done directly with a trading desk over a recorded line where the verbal terms of the contract govern until the Long-form Confirmation is created 1 – 2 business day later. Prior to this pricing call, the Borrower – generally with the assistance of a hedging advisor – pre-negotiates the terms of the transaction with both i) the lender and their counsel and ii) one or more trading desks.

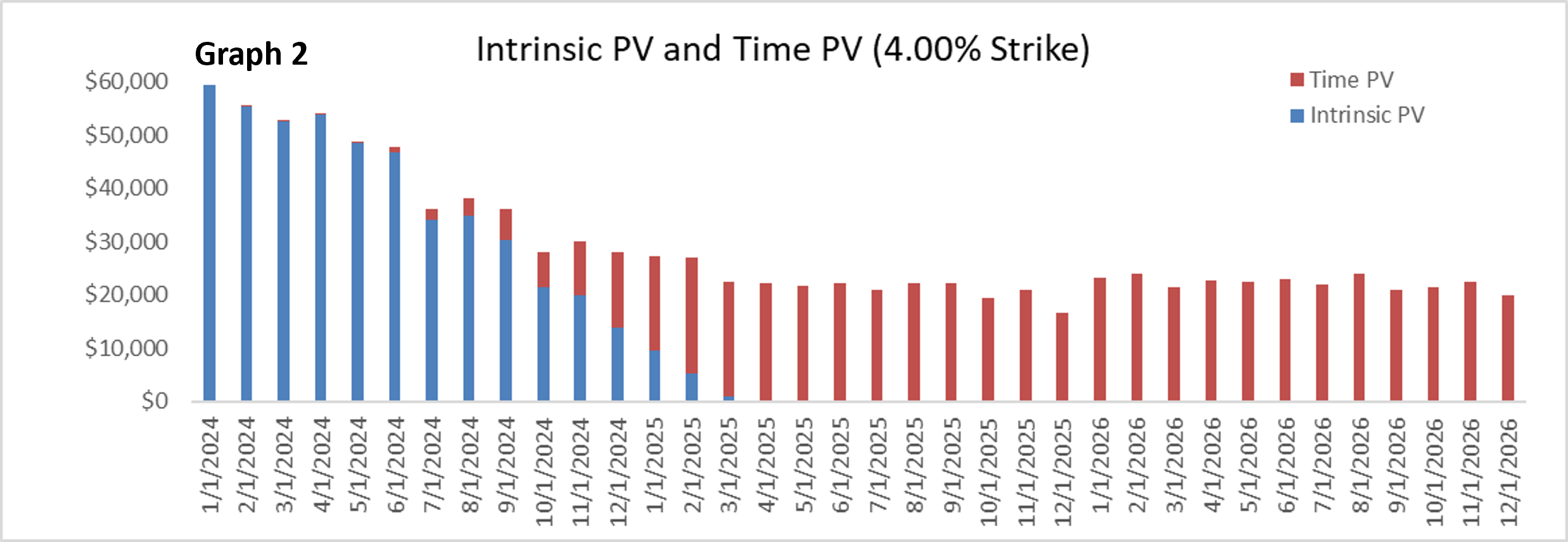

The cost of the cap, or Premium, is the present value total of the intrinsic value and time value plus the dealer’s profit. The graphs below represent what these values look like. It helps to think of a 3-year interest rate cap as 36 independent one-month “caplets” that can each be in-the-money or out-of-the money based on the projected forward rate for each one-month period. Graph 1 shows how a cap strike of 4.00% compares to the current 1M Term SOFR forward curve. Any time the forward rate exceeds the cap strike, that caplet has intrinsic value. Any time the forward rate falls below the cap strike, that caplet has only time value. In-the-money caplets that are close to the forward rate have both intrinsic and time value. Graph 2 shows the actual intrinsic value and time value for each caplet corresponding to the forward rate in Graph 1. This pricing is based on a $50mm, 3-year cap with a 4.00% strike. The cost of this cap – on December 1, 2023 – is $1,045,000. This is the sum of all the 36 columns in Graph 2.

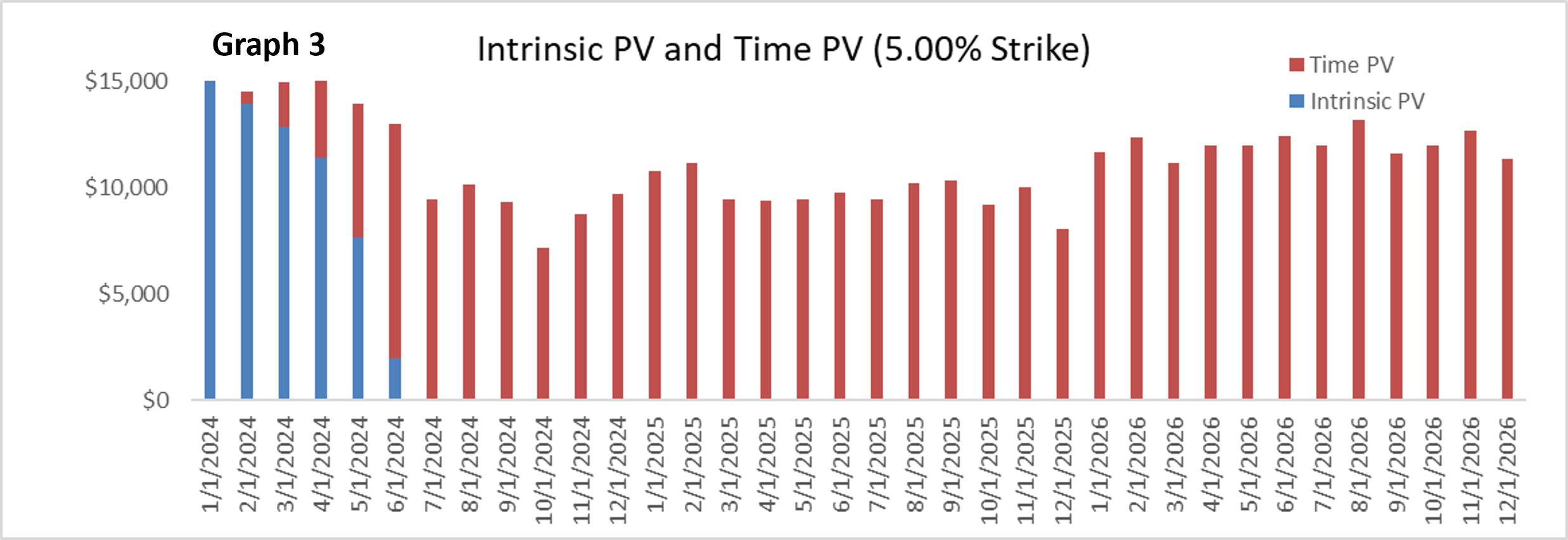

Determining the appropriate strike for a cap can be challenging for buyers. In general, the higher the strike rate, the lower the price. However, cheaper doesn’t always mean better. As we can see if Graph 3 below, our same cap at a 5.00% strike has very little intrinsic value. Of the $400,00 total cost of the cap, $340,000 is time value. If the forward curve is 100% accurate – which we know it never is – the Borrower will be paid $60,000 back over time through cap payments* (intrinsic value).

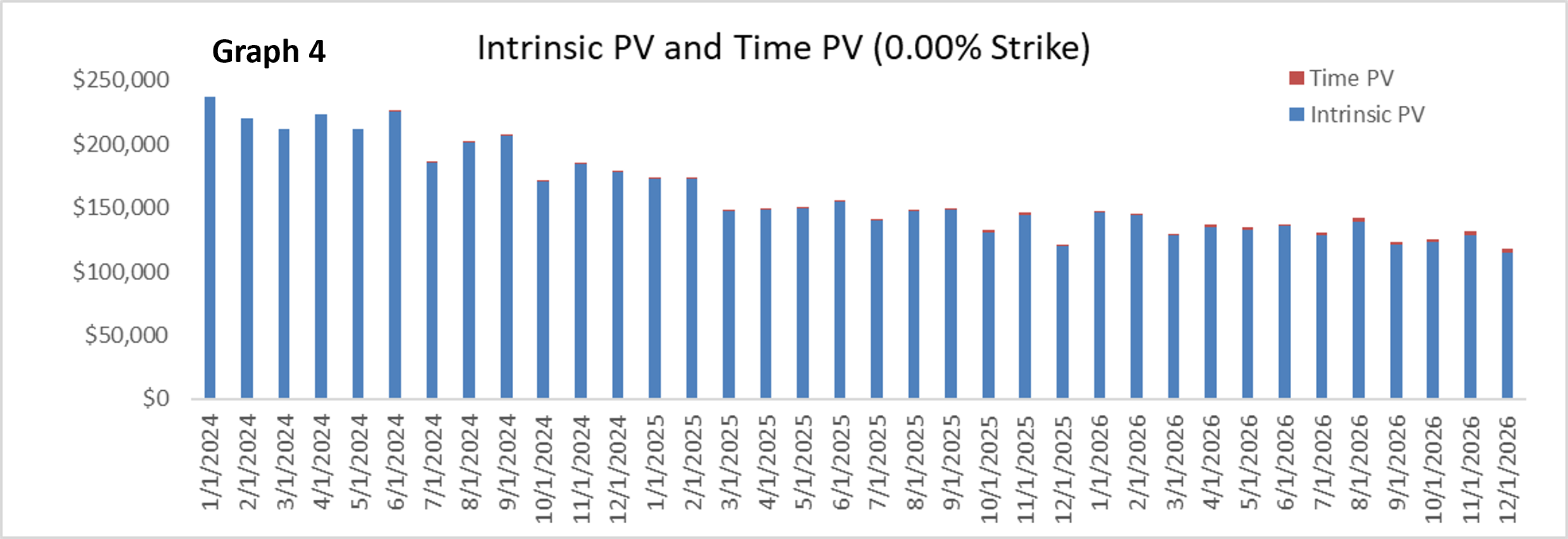

Graph 4 is a more extreme example and uses a 0.00% strike for our cap. Of the $5,840,000 total cost of the cap, $34,000 is time value. If the forward curve is 100% accurate – which we know it never is – the Borrower will be paid $5,806,000 back over time through cap payments* (intrinsic value). Depending on the Borrower’s cost of debt versus equity, it may choose to pay a higher premium for the cap today to achieve a lower debt service over time.

It is worth noting that the forward curve is simply the market’s current and best guess as to the forward path of interest rates. At any given moment in time, the combination of all the forward rates in the market define the term curve. If the forward curve were 100% right, interest rates would never move.

*These numbers do not account for dealer profit which varies depending on numerous factors including term, strike, and notional.

Regardless of the strike a buyer chooses, an interest rate cap should be viewed as insurance. As with any insurance policy, we do not want to file a claim. In the case of interest rate caps, a “claim” is comparable to an in-the-money payment made to a cap buyer when rates are above the cap strike. The best-case scenario – from an overall cost of debt perspective – is for a buyer’s cap to become worthless immediately after purchase. This implies that rates have fallen substantially, and the Borrower/cap buyer’s cost of debt has similarly fallen. So, while interest rate caps are put in place to protect against rates increasing over a pre-defined level, we want rates to remain low and for that cap to be worthless.

While the cap we just examined has a constant notional and strike, this does not necessarily have to be the case. Remember, the 3-year cap is the aggregate of 36 individual caplets. Each caplet can have a different notional and different strike. For a construction loan, the Borrower may want to only cap the projected amount to be drawn under the loan at any given time. This can be structured up front and would simply lower the weighting of each caplet based on the Notional. In looking at Graph 2, if our $50mm cap started at $25mm for the first month, the first bar would simply be half of that shown. This methodology would apply to every caplet throughout the term of the cap. The premium of each caplet is simply weighted based on the notional for that one-month period. Similarly, the strike can increase/decrease with each successive caplet if the Borrower determines that it would like to budget for higher/lower interest expense in the future.

Interest rate caps are powerful tools that borrowers can use to manage interest rate risk. They do not carry credit risk to the buyer of the cap after payment of the Premium so there is no underwriting process and, therefore, can be implemented quickly and with numerous providers across Wall Street (i.e. – they can be “bid out”). The more borrowers know about the products they use the better they can manage interest rate risk. A little knowledge goes a long way.

KPM Financial is a full-service, independent derivatives advisory firm providing ongoing expertise to borrowers regarding debt management, interest rate risk management, and other financial management needs. We can assist with new hedging solutions such as vanilla swaps, caps, collars, and callable swaps and provide guidance relating to terminations, assignments, and restructurings. We also provide Bond defeasance consulting services to municipal, not-for-profit, and affordable housing borrowers.