Hedging in Uncertain Times - Extending Cap Protection and Reducing Cap Reserve Requirements

Unless you are close kin to Rip Van Winkle, you know that short-term interest rates have skyrocketed as the FOMC began its historic tightening cycle in early 2022. We thought it appropriate to remind market participants of this quote from the FOMC’s Dec. 2021 meeting, “The median projection of the appropriate level of the federal funds rate is 0.9 percent at the end of 2022, about ½ percent higher than projected in September. Participants expect a gradual pace of policy firming, with the level of the federal funds rate generally near estimates of its longer-run level by the end of 2024.” (1) Fast forward eighteen months from that statement, we have a fed funds rate in excess of 5.00%, core PCE (the FOMC’s favored inflation reading) at 4.70% and talk of additional gradual firming.

(1) Source: Federal Reserve, Transcript of Chair Powell’s Press Conference, December 15, 2021

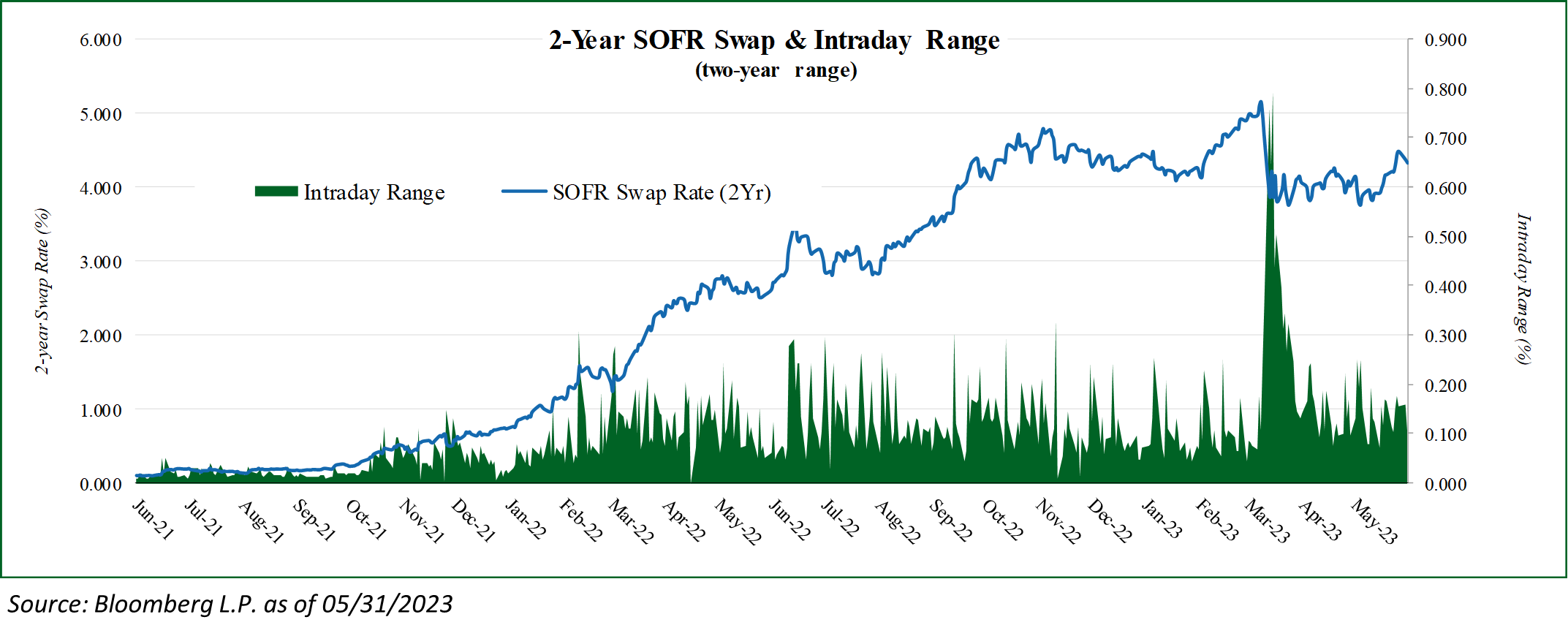

2 Year SOFR Swap Rates with Intraday Range

Thanks, Captain Hindsight! The reason for this walk down memory lane is to point out that economic projections (and the “market”) are just that, projections. The Fed employs over 400 Ph.D. economists, and that was the best they could do. Nobody knows where interest rates, or any other measure of the economy, will be a year or two down the road. That brings us to the point of this paper, hedging. It’s easy to look back and pat yourself on the back for hedges entered in late 2021 or early 2022, and almost as easy to fire your portfolio manager for not hedging against the risk of rapidly and unpredictably rising rates when the opportunity was “obvious.” It’s harder to look at the market before us and make decisions that will have implications for the years to come.

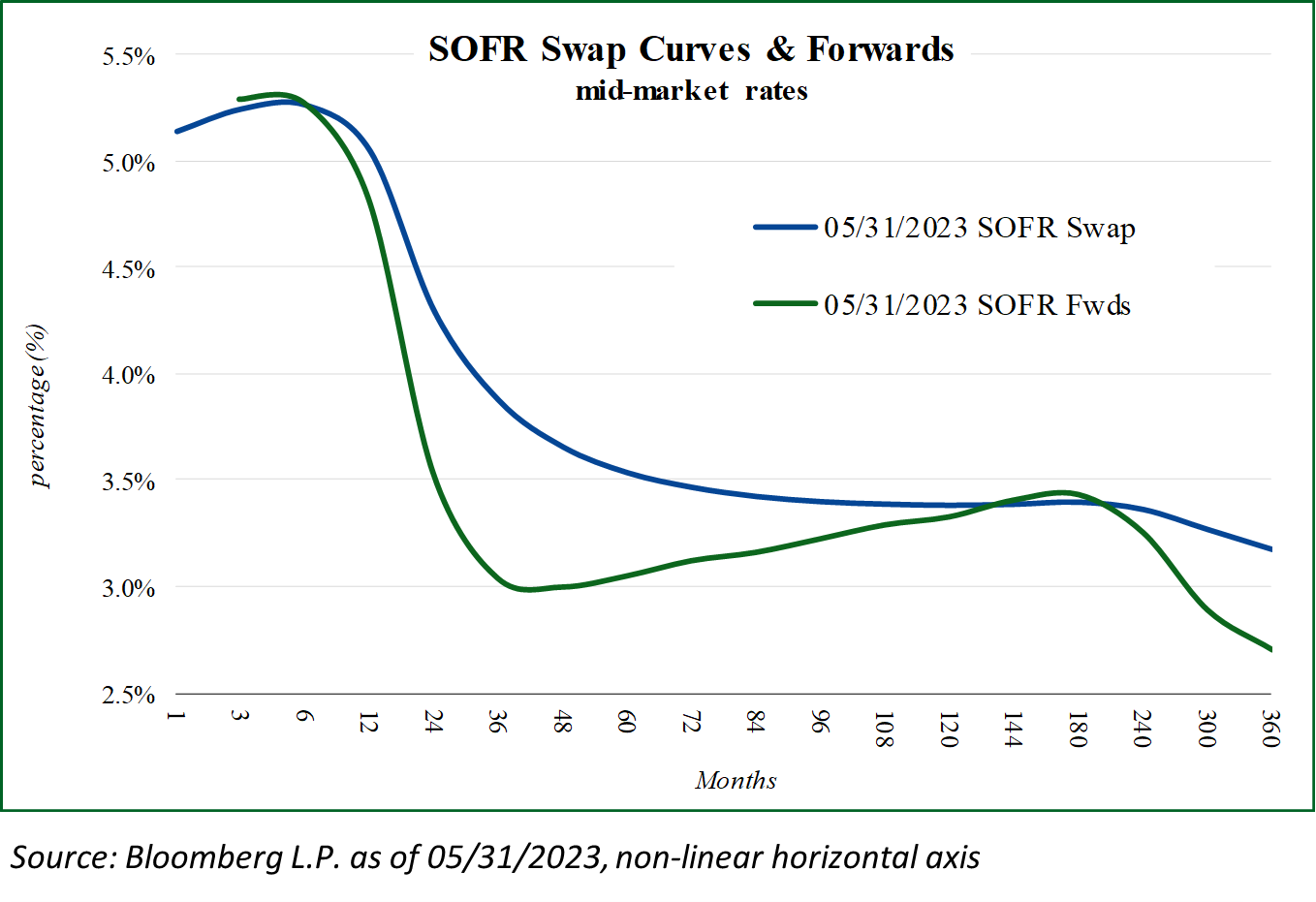

So, what is an investor to do? In uncertain markets, investors should focus on managing the risks they can control. One such risk is interest rate risk. The “market” is discounting the cost of purchasing hedges that become effective in the future, referred to as forward starting swaps or forward starting caps. The steeply inverted yield curve creates much lower forward rates than the current SOFR rate, 5.06%. This inversion is caused by market expectations that the FOMC will cut rates sharply over the next several months. Will they? I point you back to paragraph one! Nobody knows. The inverted curve creates the unusual phenomenon of cheaper forward-starting caps than spot-starting caps or forward-starting swap coupons well below current SOFR rates.

SOFR Swap Curve and SOFR Forwards

For example, the following are indicative swap rates and cap prices as of the time of this writing.

Current SOFR Swap Pricing

And here’s the punch line, as an investor in the CRE market, if the curve is correct and rates fall precipitously over the next several months, will anyone be upset, even if they took advantage of the discounted forward starting caps?

For GSE floating rate debt, let’s further explore how extending caps can benefit cash flows. The formula for calculating the monthly required escrow deposits used to purchase a replacement cap is as follows:

Freddie Mac Rate Cap Escrow Requirement Calculation

Replacement Cap Quote: Based on a current two-year cap. Yes, much more expensive than where you could purchase the forward cap.

Escrow Factor: Typically, 125%.

Current Escrow Balance: Depending on where you are in a cycle, there may be enough in reserve to purchase the replacement cap with no out-of-pocket expense.

Remaining Term in Months: Through the end of the longest existing cap. Extending a cap in advance of the current cap’s maturity will increase the denominator, reducing the monthly required deposits.

In summary, investors can take the prudent step of mitigating exposure to further increases in floating rates or a “higher for longer” rate policy by extending the term of existing hedges well in advance of the current hedge’s maturity. For swaps, investors may be limited to the terms of the underlying credit agreements. For caps, an investor can often extend cap protection well before the existing cap’s maturity. For users of GSE floating rate debt products, not only will extending caps allow them to take advantage of discounted pricing, but it may also create an immediate reduction in their monthly escrow deposits. Nobody knows what caps will cost in the future or if new caps will even be available. For investors in commercial real estate, extending the duration of your hedges will remove one unforeseeable and uncontrollable risk. Please contact your KPM Financial advisor to further discuss the benefits and risks involved in this strategy.

KPM Financial is a full-service, independent derivatives advisory firm providing ongoing expertise to borrowers regarding debt management, interest rate risk management, and other financial management needs. We can assist with new hedging solutions such as vanilla swaps, caps, collars, and callable swaps. Additionally, we provide advice relating to terminations, assignments, and restructurings.